The dynamics of how business value is created are changing, moving from a system based largely on tangible assets to one that favors intangible ones. In the past 30 to 35 years, intangible assets have moved from 20 percent to over 80 percent of the value of public companies, but corporate decision-making has not kept pace. The reporting did not fully take these changes into account either.

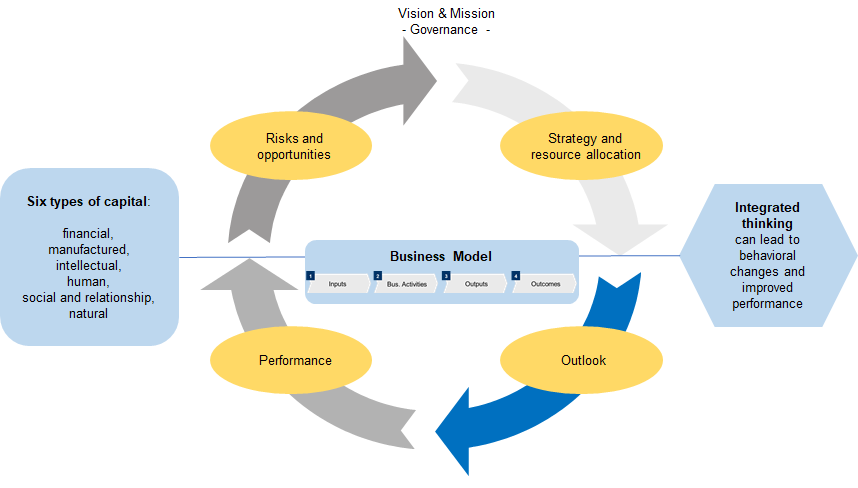

The critical elements of an integrated reporting system usually concern

- the company’s business model,

- the materiality of problems that affect value creation, and

- stakeholder engagement.

While integrated reporting is often viewed as a framework for external reporting, its greatest benefit may be its ability to promote “integrated thinking” and to enable companies to better understand the factors affecting their ability to add value over time significantly affect.

By integrated reporting, I mean improving corporate reporting to more fully explain how the company creates value in the short, medium and long term with the eyes of management.

Recommendations

Here are seven recommendations related to integrated reporting:

- Secure commitment by the board of directors and management: The organs must commit to both the financial and human capital investments required to produce an integrated report.

- Apply methods and standards that are specific to your company. The financial materiality should be taken into account; the report should be clear and understandable.

- Start with non-cyclical reporting on financial and non-financial matters. Use a pragmatic approach to meet investor expectations and to address concerns about the expense of such reporting.

- Think about what story your company wants or should tell. Start by identifying and prioritizing the target groups of the report: institutional investors and smaller shareholders, employees, customers, suppliers and organs resp. corporate bodies: CEO, board of directors, management team.

- Include the critical elements of an integrated report. Create a visual representation of your business model. Discuss the materiality of problems that can affect value creation, such as shareholder value, and stakeholder engagement that helps the company understand its needs and interests in non-financial matters. Keep the report short so that it provides information in a way that doesn’t overwhelm readers.

- Take competition and legal aspects into account. Organizations generally disclose a significant amount of information beyond what is required by law. This depends on considerations of responsiveness to investors and other stakeholders and the importance for companies to tell their story effectively.

- Expose the myths about integrated reporting. These include: There is a lack of investor interest in integrated reporting, investors have certain expectations about the form of an integrated report, and the current level of reporting is sufficient.

Reporting process

The main purpose of an integrated reporting is to explain to stakeholders how an organization creates value over time. Six types of capital contribute to the current and potential value of the company.

Role of human capital

For many companies, human capital is the most important aspect of the ability to add value. In traditional thinking, however, human capital has often been seen as just one of the largest expenses in a profit and loss account. This is offset by the fact that companies that fully engage their workforce deliver improved results, not only financially, but also in terms of improved customer relationships, greater innovation, fewer security problems and many other dimensions. It is often the most important asset of a company because business models focus on people, intellectual capital and technology.

This goes hand in hand with a longer-term orientation of the reporting system. Short-term thinking can prevent companies from making bold investments and implementing future-oriented strategies that require sustainable growth and a dynamic economy. There are many causes, including structural systems that have been developed over decades and are designed for immediate performance. At the same time, companies and many investors want longer-term prospects for strategic planning. A broader view of performance can help companies demonstrate their unique culture, long-term thinking, and other highly relevant but intangible elements that work together to add long-term value.

Conclusion

The fact that an integrated reporting system is not a fad, but that it actually provides benefits, is argued by following reasons:

- The way how business value is created changes and it would be helpful if the reporting standards changes accordingly.

- Intangible items now dominate a company’s asset.

- The more business models are focused on people and technologies, the more valuable human capital becomes.

- Integrated reporting distinguishes between six types of capital (financial, manufactured, intellectual, human, social and relationship, natural) that provide a more complete understanding of the factors that affect value creation.

- Integrated reporting is a tool for internal decision making (often referred to as integrated thinking) and for external communication of the impact of these decisions.

- Integrated thinking represents a five-step-approach – relevant topics and stakeholders, committed managers, KPIs and dashboards, change plan, integrated report – and leads to higher added value.

Among other things, further insights into an integrated reporting system are provided by Bob Laux from the International Integrated Reporting Council.

Leave A Comment