Up until now, a change of established business models has happened only slowly, but increasingly the pressure on insurers grows (part 1: customer journey; part 2: data-driven business models): the present business model is a phase-out model! Technological trends and developments, which the study “Assekuranz 4.0” calls the digital triangle, are the drivers for the necessary digital transformation in the insurance industry and also showcase its great potential.

Insurers in the digital triangle

The digital triangle differentiates between three fields − Smart Analytics, Industrialisation/Automation and Customer Interaction −, which influence each other. Along the possibilities of Smart Analytics insurance companies will become data-driven organisations. This involves different trends like the AI-assisted Hybrid Cloud, BDAP (Big DAta Placement Strategy), Kubernetes, ledger technology and edge computing.

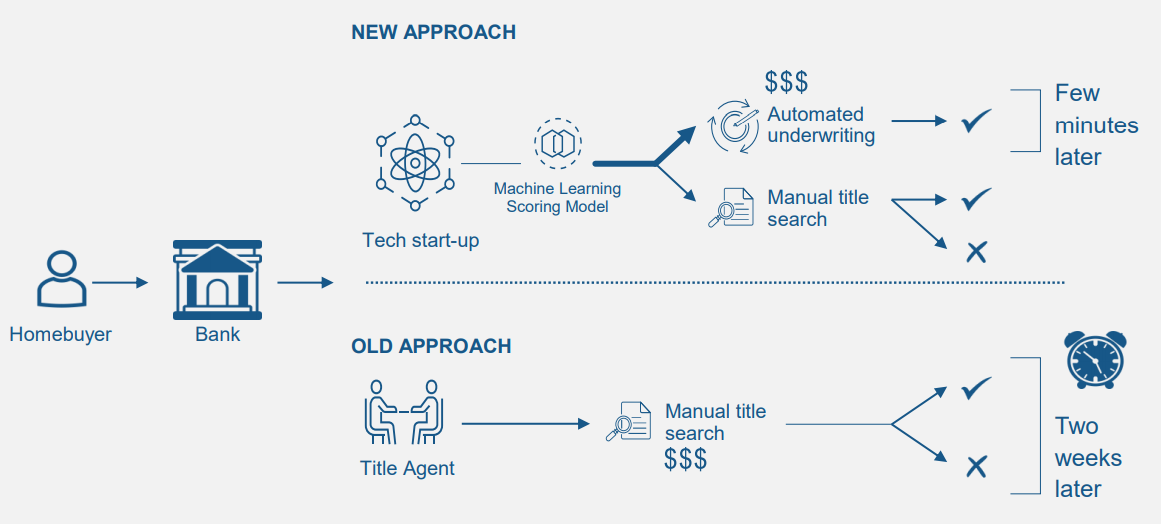

With the help of analytics, processes such as risk assessment or policy making can be partially automated or completely automated at least be accelerated and simplified (source: alexanderthamm).

The possibilities that arise from new, self-learning systems are numerous. Blockchain solutions, Machine Learning and Robotic Process Automation (RPA) can be distinguished as constituting Industrialisation/Automation.

The area of Customer Interaction concerns itself with presenting necessary information in an apposite form. The design of future interactional processes is likely to be simplified when it is mostly divorced from channels and they remain to be only understood as the modular front end of a uniform structural foundation. Interesting in this regard is the field of Robo Advisory, the application of different targeting tools, identity platforms as well as augmented reality and remote viewing technology.

Docking points of the InsurTechs

The new competitors, namely start-ups in the InsurTech sector with their digitalisation dynamic put pressure onto established insurers. InsurTechs use digital information and communication channels for individualised customer approach and consulting. The point of contact with customers is essential for the collection of important data and the visibility of business and brand.

Immediate challenges

It is necessary to expand data-driven business models − possibly with inclusion of InsurTechs −and by doing so, to initiate a cultural change. Many digital technologies will revolutionise the customer experience. A crucial challenge for insurers in this context will be the availability and utilisation of the necessary data.

Leave A Comment